Stay at home rules have impacted the way we live. With working from home as “the new normal” and restrictions on going out, more people in Australia have started considering buying their own home or a home upgrade.

The idea of having more space, spending more time with family and enjoying the outdoors has led to a 45% increase the search for properties for sale, according to REA Insights.

Why now?

With historic low interest rates and up to $65,000 in benefits in Victoria, there has never been a better time to buy your first home.

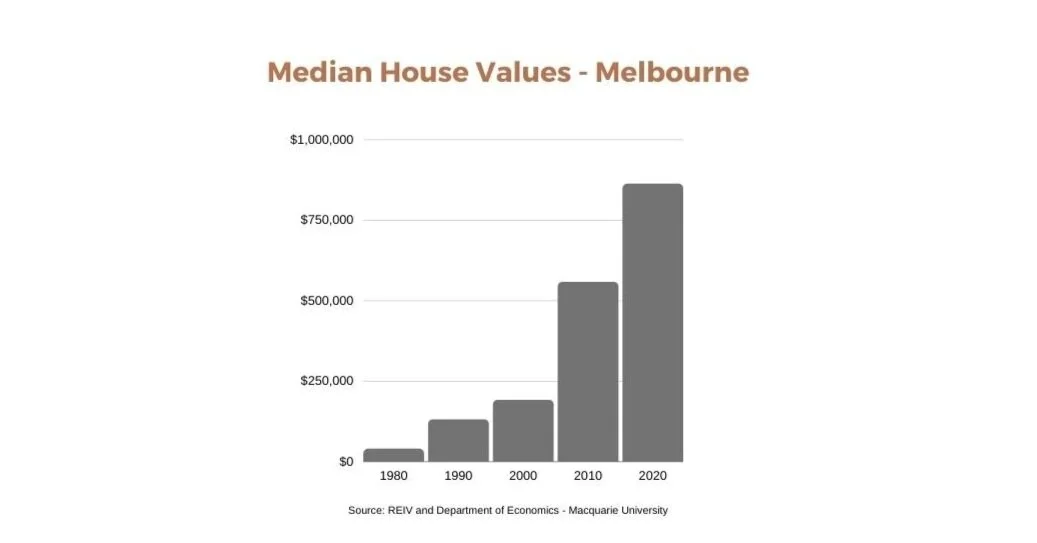

When it comes to the house value, Melbourne has registered an average gain of 8.1% per year, or a growth of $28,325 per year on average, over the last 25 years.

Even though the pandemic has impacted the property market and the investments, the demand for first home buyers in April 2020 was more than 20% higher compared to December 2018 according to Australian Bureaus of Statistics.

Over the last 43 years, the median price of house in Melbourne has risen 23 times, from $37,088 to approx. $893,000 in March 2020, according to REIV.

How can we help?

At SONI, we will work with you, educate you on the government incentives that are available and identify the best option for your future.

Whether a house & land package, townhouse or even an upcoming apartment, we will help you find a property that fits your goals and enables you to utilize the government incentives.

We also guide and help you organize finance and assist throughout the entire construction process for a seamless experience.

To get into your new home sooner than you think, talk to us today.