MELBOURNE REAL ESTATE UPDATE

Melbourne has long been one of Australia’s top-performing housing markets. While other capital cities have experienced strong growth over the past couple of years, Melbourne's property prices have remained relatively stable.

Let’s dive into the current state of Melbourne’s real estate market and explore why now might be the perfect time to invest in one of the world’s most liveable cities.

House Values: Resilience Amidst Slowdowns

Melbourne’s housing market witnessed significant growth during the pandemic, continuing until early 2022. However, the Reserve Bank of Australia’s (RBA) interest rate hikes beginning in April/May 2022 marked a notable slowdown.

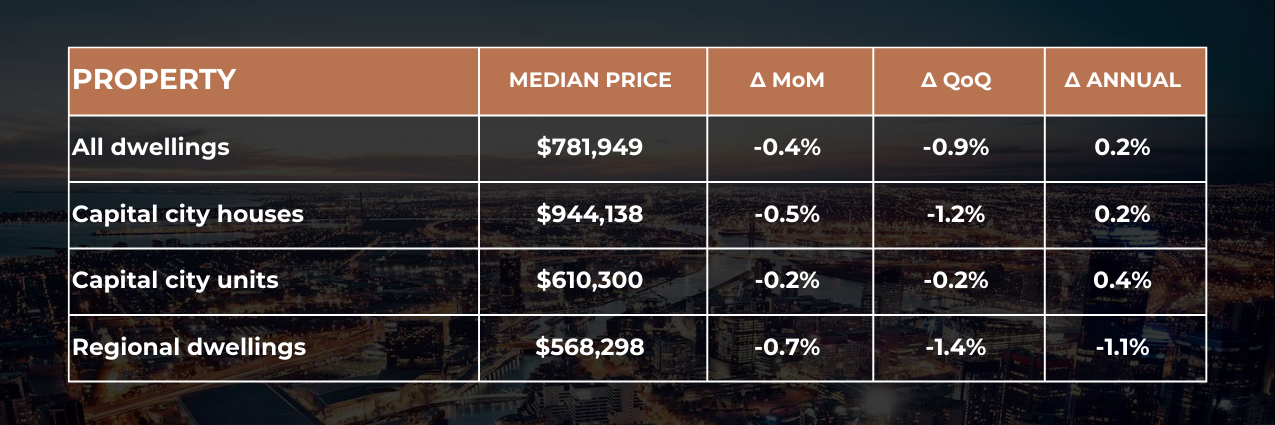

As of July 2024, dwelling values have declined by 0.9% over the last quarter, but on an annual basis, they have still seen a slight increase of just over 0.2%. (CoreLogic Home Value Index Report 2024)

Housing Cycle - Melbourne (April-August 2024)

Despite these modest declines, Melbourne's property values have shown remarkable resilience. The median house price currently sits just under $950,000.

While growth has slowed, Melbourne’s real estate market continues to show underlying strength, making it well-positioned for future recovery and growth.

Melbourne Dwellings Change

Vacancy Rates: Strong Rental Market

Melbourne's rental market is currently facing exceptional demand, which has driven vacancy rates down to under 2%. According to SQM Research (July 2024):

Melbourne's vacancy rate sits at just 1.5%.

Annual growth in rent values is 8.5%

Rental Yield for houses sits at 3.6% and units at 5.4%

Quarterly Vacancy Rate and Rental Yield - Melbourne (April-August 2024)

This sharp decline in vacancy rates reflects Melbourne's strong demand for residential real estate. While finding rental properties has become more challenging, the city’s appeal as a desirable place to live and work remains undiminished, reinforcing its ongoing appeal in the property market.

Population Growth: Fuelling Demand

In the year ending June 2023, Australia's capital cities experienced record-breaking population growth, with over 500,000 new residents - the largest annual increase ever recorded by the Australian Bureau of Statistics (ABS).

Population Change in Victoria (2012-2023)

Melbourne led the way, with a population increase of 167,500, reflecting a growth rate of 3.3%. Victoria experienced the biggest population increase over the last year, driven primarily by a steady inflow of international arrivals.

Currently, 5.8 million people are living in Melbourne. The city's appeal as a centre for jobs, education, and entertainment continues to attract residents from interstate and overseas.

The Victorian government’s plan to increase Melbourne's population to 8 million by 2050 means continued demand for housing, presenting a significant opportunity for investors.

Supply Challenges: constraints in the pipLINE

Melbourne's housing market faces significant supply challenges despite an increase in homes for sale. According to the Commonwealth Bank of Australia (CBA), the number of homes available in Melbourne has returned to pre-pandemic levels, surpassing the decade-long average.

However, this rise hasn't kept pace with the high demand from new immigrants and low vacancy rates.

2024 is expected to see the lowest number of new home completions in Victoria in a decade.

The Australian Bureau of Statistics (ABS) reports that there are currently 68,100 homes under construction across the state, 6% fewer than a year ago. This decline is largely due to a slowdown in high-density apartment construction.

Greater Melbourne’s new home market has also experienced a subdued performance. There has been a sharp decline in greenfield land sales and another flat year for multi-unit sales, with house approvals down by 7% and unit approvals by 29%.

Melbourne's population is expected to grow significantly in the coming years, and the city will require approximately 1.5 million additional homes.

These factors underscore the ongoing struggle to balance supply and demand in Melbourne's housing market, with new home completions expected to decrease further over the next three years due to a weak production pipeline.

UDIA Report, Melbourne - 2023

Interest rate forecast and predictions for 2024-25

Inflation is expected to slow down to the RBA's target range by late 2024.

Until then, the RBA will keep interest rates high and is expected to maintain strict control over monetary policy. This means mortgage rates will remain high until inflation reaches the RBA's goal.

Once inflation aligns with the target range of 2% to 3%, likely in early 2025, the RBA will gradually lower the interest rates to boost the economy. This will lead to lower variable home loan rates and reduce monthly mortgage payments, making it easier for many Australians to manage their mortgages.

Below are some of the interest rate predictions by our four major banks (Commonwealth Bank Australia, Westpac, and National Australian Bank) :

Interest Rates Predictions by Big Four Banks - Australia

The Future: A Window of Opportunity

As demand continues to rise and supply remains at its lowest, Melbourne's property market stands out for its resilience. While other cities are cooling off after record growth, Melbourne is uniquely positioned for a strong resurgence.

Now is the perfect time to invest in Melbourne, as the market is primed for significant growth in the coming years.

Why SONI Wealth

At SONI Wealth, we specialize in navigating complex market conditions and find the best investment opportunities. Our deep understanding of the Melbourne property market enables us to craft tailored investment strategies that align with your financial goals.

Whether you’re looking to take advantage of current market conditions or planning for long-term wealth creation through property investment, our team is here to support you every step of the way.

References: