Houses vs. Apartments: Which is the Better Investment?

Property investment is an enticing venture, but when choosing between an apartment and a house, navigating the options can be a bit like charting uncharted waters. Whether you are a seasoned investor with years of experience or a newcomer stepping into the property market, understanding the finer details of apartment and house investment is the key to making the right investment decision.

One common misconception among property investors is the belief that houses invariably outperform apartments due to the appeal of land ownership. However, it is important to understand that both houses and apartments offer unique advantages, and the ever-evolving preferences of Australians are reshaping the property market in various ways, making it crucial to approach this decision with an open mind.

With their spacious yards and the appeal of land ownership, houses are a compelling choice for those seeking stability, room to grow and a promise of traditional family home. On the other hand, apartments come with different benefits, catering to the preferences of urban residents who prioritize convenience, a vibrant city lifestyle, luxury living and potentially lucrative rental income opportunities.

In this article, we will explore the distinct advantages of each investment type, equipping you with the knowledge needed to make a well-rounded decision, free from bias or preconceived notions.

1. ENTRY POINT IN THE MARKET

Houses:

Houses often come with a higher price tag, mainly due to the value of the land they include. This can be a limiting factor for potential buyers, including first-time property investors or those looking to diversify their investment portfolio.

Apartments:

Apartments have emerged as popular choices among investors due to their relatively affordable prices compared to houses. If you’re trying to diversify your portfolio or are a first-time investor, apartments offer an affordable entry point into the market in areas that would otherwise be beyond your budget.

The latest CoreLogic data shows that the median house price in Melbourne is $938,000, while the median unit price is $631,000. Similar disparities in pricing exist in other cities, such as Sydney, where the median house value is $1,333,985 and the median unit price in is $817,059.

With the same budget that might purchase a house, investors could acquire multiple apartments, thereby - spreading their risk across different properties and potentially enjoying a stable rental income stream.

Here is the latest data on the median property prices for Melbourne:

Source: Core Logic

2. ONGOING PROPERTY COSTS AND MAINTENANCE

House:

House ownership entails covering all the maintenance and upkeep fees, as well as insurance premiums for the building itself, if you choose to take out a policy. You should ensure the home is structurally sound, including getting a thorough building inspection prior to purchase.

Houses come with more responsibility, including repairs, insurance, council rates, etc. which can accumulate significantly over time as the property ages.

Apartments:

As an apartment owner, you benefit from shared maintenance, upkeep, and insurance costs through a strata title arrangement. The owners' corporation, or body corporate, manages the common areas and charges body corporate fees to all owners.

However, over time body corporate fees can increase, making it essential to consider their impact on your budget.

3. RENTAL YIELD

Houses:

Houses usually have a lower rental yield than apartments, despite historically achieving greater capital growth in the long term. If your investment strategy prioritises rental income for cash flow rather than capital growth, this is an important consideration.

Apartments:

Apartments have an edge in terms of rental yield. The high population density in urban centres creates a strong demand for apartments, allowing investors to enjoy attractive rental yields. The recent trends also position apartments favourably in terms of their rental yields.

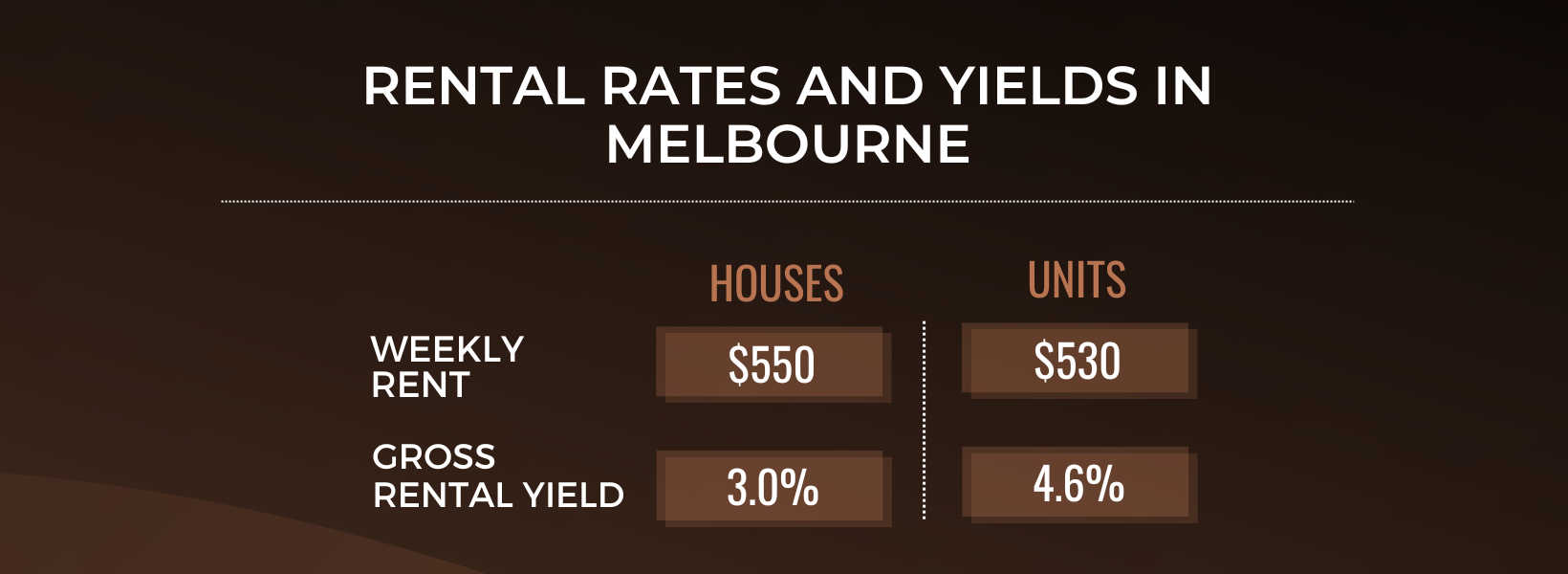

The August 2023 SQM Property Gross Rental Yield shows the gross rental yield in Melbourne of units is 1.6% more than that from houses. (Rental yield of units = 4.6%, houses = 3%)

Additionally, well-developed luxury apartments often come with shared amenities and facilities, making them more appealing to potential tenants and increasing the likelihood of higher rental income.

Here are the current rental rates and yields between houses and units in Melbourne:

Source: Core Logic

4. LONG TERM CAPITAL GROWTH

Houses:

Historically, houses have appreciated in value faster than units in Australia, giving houses an edge in terms of long-term capital growth. However, it is essential to recognize that not all locations exhibit similar performance, so identifying and investing in areas with growth potential is essential.

Houses often have a higher land-to-asset ratio than apartments, and the limited supply of land in capital cities makes houses more scarce and therefore more valuable.

Apartments:

Well-located apartments can also yield robust capital gains. For instance, an isolated house in a remote area is likely to appreciate less compared to an apartment in a vibrant inner-city suburb. Location and market conditions should always be considered when investing.

Apartments often have much higher depreciation due to greater build value, which can help investors maximise their tax refunds and improve cash flow.

5. SUPPLY AND DEMAND DYNAMICS

Supply and demand dynamics play a pivotal role in property investment decisions. While family households remain prevalent in Australia, there has been an increase in single- and two-person households over the years.

According to the Australian Bureau of Statistics (ABS), lone-person households will rise from 2.3 million in 2016 to between 3 to 3.5 million households by 2041.

While houses are still popular for bigger families, apartments are becoming a more convenient choice for individuals, couples, and newcomers to Australia, such as migrants, students, and downsizing Australians.

These individuals typically prefer living closer to the city, and apartments are often aligned with their needs.

MAKING THE CHOICE

The decision between apartments and houses is not a simple one. Each has its own benefits and challenges, making careful analysis a necessity for investors. Consider your financial goals, risk tolerance, and current and future market conditions when deciding which is the better option to invest in.

If you're looking for a lower entry point, higher rental income, and a comfortable-to-hold investment, apartments might be the right choice for you. On the other hand, if you're more interested in the value of the property increasing over a long time and having sufficient cash flow to hold on to it for a longer period of time while it grows in value, houses could be a better fit.

In the end, staying informed about market trends and getting advice from experts can help you make a smart decision aligned with your investment objectives.

TEAM SONI CAN HELP

SONI Wealth is your trusted partner for Property Investment. With our experience and knowledge, we can help you achieve your financial goals, whether you are a first-time homebuyer, a new investor, or an experienced investor.

We have a proven track record of success and we offer a comprehensive range of services to support you every step of the way. From finding the right property to managing your investment, we are here to assist you.

Contact us today to learn more about how we can help you build long-term wealth through property investment.